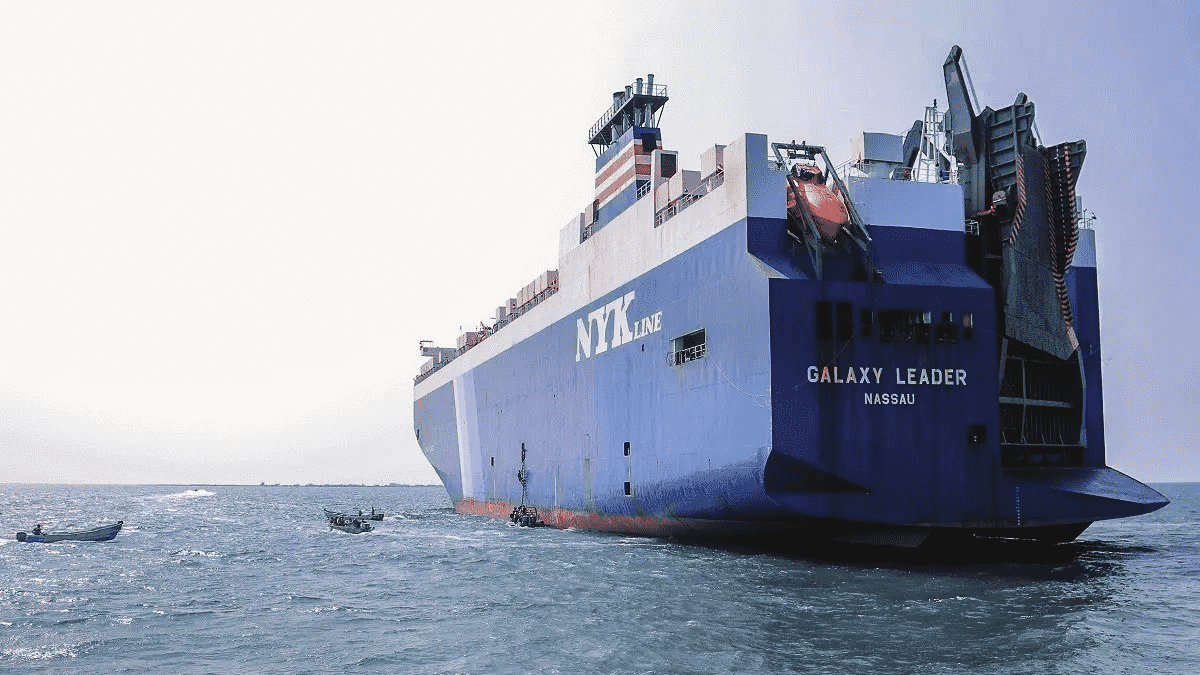

Recent attacks on merchant ships in the Red Sea are posing a significant threat to the global economy and maritime trade, adding to the challenges already faced by the shipping industry, such as disruptions at the Panama Canal. The assaults, attributed to the Houthi armed group backed by Iran, have prompted shipping companies to avoid the Suez Canal, forcing them to take longer routes.

The Houthis have utilized drones and missiles to target ships since an attack by Hamas on Israel on October 7, 2023. This has led major shipping and oil companies to circumvent the Suez Canal, a critical passage for container ships and fuel tankers. The potential ramifications include hampering global trade and increasing the cost of imported goods.

The Suez Canal, under Egypt’s control since 1869, is vital for transporting goods and fuel from Asia and the Middle East to Europe and the United States. Approximately 50 vessels

pass through the canal daily, with recent data indicating that at least 32 had been diverted as of Monday. Chris Rogers, head of supply chain research at S&P Global Market Intelligence, noted that nearly 15 percent of European imports rely on the Suez Canal route.

The Red Sea and canal issues are described by Peter Sand, chief analyst at Xeneta, as “a slow-burning disaster that blew up on the weekend.” The situation has prompted global shipping stakeholders to assess the impact on supply chains and shipping routes.

The Red Sea and canal issues are described by Peter Sand, chief analyst at Xeneta, as “a slow-burning disaster that blew up on the weekend.” The situation has prompted global shipping stakeholders to assess the impact on supply chains and shipping routes.

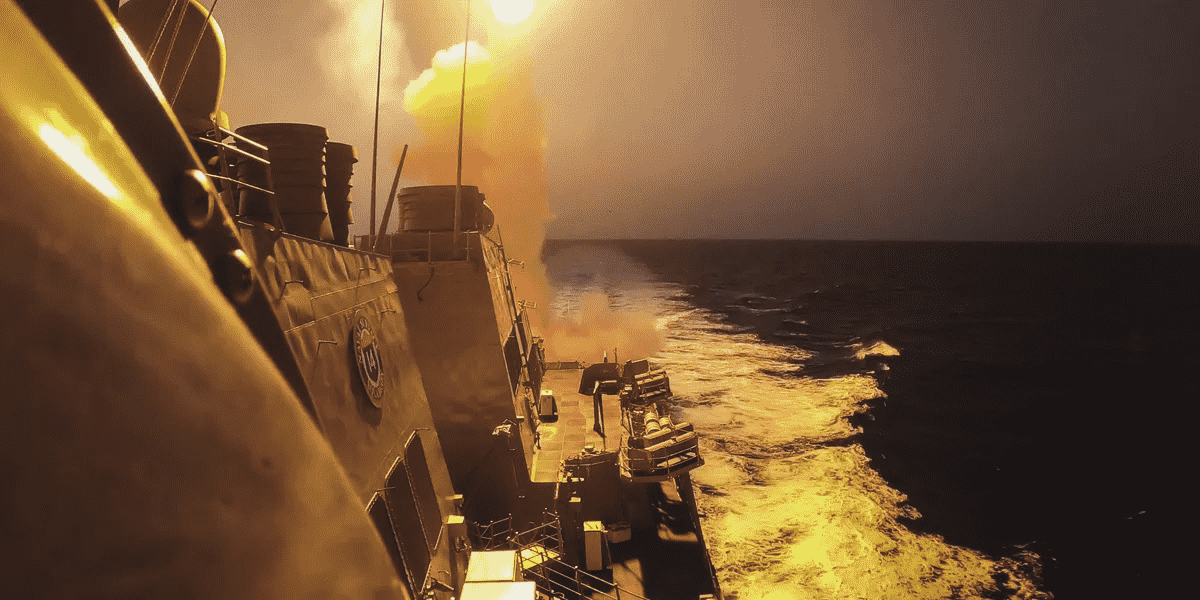

In response to the escalating threats, U.S. Defense Secretary Lloyd J. Austin III announced a new multinational force, including the armed forces of the United States, Britain, Bahrain, Canada, and France. This force aims to address security challenges in the southern Red Sea and the Gulf of Aden, ensuring freedom of navigation and enhancing regional security.

BP, a major oil company, announced the suspension of shipments through the Suez Canal due to the “deteriorating security situation for shipping.” Other companies transporting products from Asia, such as Maersk, have also halted vessels, rerouting them around Africa via the Cape of Good Hope for the safety of crews and cargo.

The impact of these developments is not limited to shipping; it extends to the global economy. With approximately 12 percent of world trade passing through the Suez Canal and 5 percent through the Panama Canal, disruptions force shipping companies to incur millions of dollars in additional fuel costs for longer routes.

Taking the Cape of Good Hope route instead of the Suez Canal can add around $1 million, or about a third, to around trip from Asia to Europe. Some shipping rates have already risen by 20 percent in recent days, reflecting the economic consequences of these challenges.

The attacks have led to increased oil prices, with Brent crude rising about 8 percent over the past week. The situation has prompted calls for international intervention to address the security challenges in the Red Sea and safeguard vital maritime trade routes.

The attacks have led to increased oil prices, with Brent crude rising about 8 percent over the past week. The situation has prompted calls for international intervention to address the security challenges in the Red Sea and safeguard vital maritime trade routes.

In addition to concerns about rising oil prices and shipping rates, the attacks have raised questions about the safety of vessels in the region. Several shipping companies, including Maersk, MSC, and others, have suspended operations in the Red Sea, affecting approximately half of the global container shipping market. Insurance risk premiums for sailing through high-risk areas have surged, reflecting the heightened risks associated with the Red Sea.

The situation has also prompted considerations about the broader geopolitical implications, with the Houthi group’sactions influencing regional dynamics and testing international responses. As the United States and its allies discuss a multinational maritime task force to protect Red Sea routes, tensions in the region are further heightened.

Consumers may feel the impact of these disruptions, not only through potential delays in the supply of goods but also through the prospect of higher prices for essential products. Shipping companies are faced with challenging decisions, balancing the risks associated with navigating the Red Sea against the added costs and delays of alternative routes.