A transformative shift is underway in India’s logistics sector. International alliances, government-backed infrastructure upgrades, and rapid digitization fuel the change. As global supply chains become more intertwined and customer expectations rise, Indian logistics providers are entering a crucial phase of evolution.

A transformative shift is underway in India’s logistics sector. International alliances, government-backed infrastructure upgrades, and rapid digitization fuel the change. As global supply chains become more intertwined and customer expectations rise, Indian logistics providers are entering a crucial phase of evolution.

SECTOR SNAPSHOT: RESILIENCE MEETS OPPORTUNITY

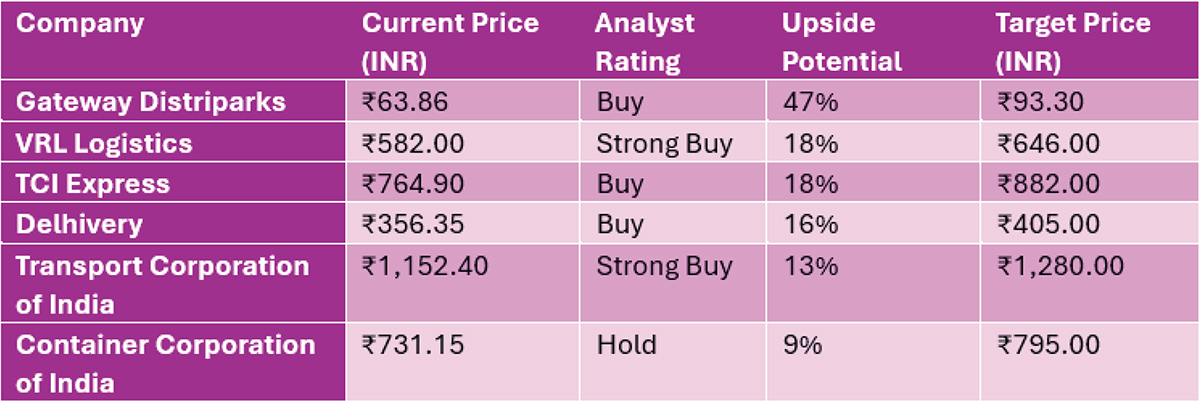

Despite a year marked by market fluctuations and investor caution, India’s logistics sector is regaining momentum. Strategic moves—such as the recently signed bilateral agreement with Japan—signal a renewed commitment to improving efficiency, reducing costs, and attracting foreign direct investment into logistics infrastructure. With upside potential projected as high as 47% for select stocks and robust performance indicators from leading logistics firms, the sector is positioning itself as a key driver of India’s economic future. This article examines the current performance, near-term outlook, and top-performing companies poised to capitalize on the sector’s upward trajectory.

MIXED SIGNALS, PROMISING FUTURE

MIXED SIGNALS, PROMISING FUTURE

India’s logistics sector is at an interesting juncture—recovering from recent setbacks while charting a more optimistic course for the future. Sector performance has seen a noticeable uptick in the past month, hinting at a rebound after a challenging year that tested investor confidence.

One of the most significant catalysts on the horizon is a newly signed bilateral logistics agreement between India and Japan. This partnership is expected to streamline supply chains, reduce operational costs, and expedite delivery times, thereby strengthening trade ties between the two nations. The agreement is also poised to unlock foreign direct investment (FDI) into India’s logistics infrastructure—an encouraging signal for long-term transformation. Analysts project a potential upside of up to 47% for leading logistics stocks, underscoring the sector’s growth potential. With the adoption of technology, global partnerships, and evolving supply chain models, companies that can remain agile and innovation-ready are likely to emerge as winners.

COMPANIES TO WATCH

Analysts have identified six companies with strong fundamentals and promising upside potential. Here’s a look at the front-runners reshaping the logistics space:

WHAT MAKES THESE PLAYERS STAND OUT

Gateway Distriparks: Gaining Ground with Intermodal Efficiency

Gateway Distriparks: Gaining Ground with Intermodal Efficiency

Gateway Distriparks is building strength as a major player in intermodal logistics, operating inland container depots and freight stations. With a sharp focus on EXIM (export-import) connectivity, the company has carved out a strong position in India’s logistics grid.

Backed by a 47% upside potential, the company’s robust performance includes a staggering 619.61% YoY PAT growth and an 8.11% increase in sales, signaling operational agility and effective execution.

VRL Logistics: Driving National Connectivity

A household name in goods transportation, VRL Logistics has a powerful nationwide fleet and specializes in LTL (Less Than Truckload) movement. Its wide service offering includes parcel delivery and complete truckload solutions, making it an essential part of India’s cargo ecosystem.

Analysts have given VRL a ‘Strong Buy’ rating, driven by 244.71% YoY PAT growth and 9.43% sales growth. With an 18% upside potential, the company is clearly on a strong growth path.

TCI Express: Delivering Speed and Precision

Focusing on time-definite deliveries, TCI Express is known for its express cargo services by road and air. The brand has earned customer trust for its pan-India reach and quick turnaround solutions.

Despite a 40.39% dip in PAT, the company maintains a ‘Buy’ recommendation, supported by a modest 1.03% sales growth and long-term prospects for profitability through strategic recalibration.

Delhivery: Powering the Digital Supply Chain

One of the newer faces in the sector, Delhivery has quickly established itself as a tech-first logistics powerhouse. Catering mainly to e-commerce and enterprise supply chains, its fully integrated network offers end-to-end solutions.

With a 16% upside, Delhivery’s numbers are promising—205.97% YoY PAT growth and 9.71% sales growth—showing that the company is bouncing back with renewed momentum.

Transport Corporation of India: A Multimodal Veteran

Transport Corporation of India: A Multimodal Veteran

TCI continues to lead with its multimodal logistics model, blending road, rail, and warehousing services. Its broad-based supply chain capabilities allow it to support a range of industries with tailored logistics solutions.

A ‘Strong Buy’ rating from analysts reflects TCI’s stable positioning, with an 11.85% growth in PAT and an 11.62% increase in sales. The company’s clear strategic vision makes it a solid long-term bet.

Container Corporation of India (CONCOR): A National Backbone

As a key government-backed entity, CONCOR plays a pivotal role in India’s containerized transport and warehousing infrastructure. It operates across both EXIM and domestic sectors, although recent headwinds have impacted growth. Currently rated a ‘Hold’, CONCOR’s 5.81% PAT decline and 2.7% sales growth suggest the need for operational tweaks. However, with a 9% projected upside, it remains a stock to watch as it recalibrates its strategy.

SHIFTING GEARS TOWARDS GROWTH

India’s logistics sector is no longer just a cost center; it’s fast becoming a growth engine. With supportive government policies, increasing foreign direct investment (FDI), and the adoption of new technologies, the ecosystem is transforming rapidly.

As international partnerships mature and domestic demand strengthens, logistics providers that invest in digital infrastructure, customer service, and sustainability will shape the future of the sector.

For CSS, staying informed about these market dynamics offers a unique vantage point to anticipate shifts, identify new opportunities, and build resilient, future-ready supply chains.