As global trade continues to evolve, the Middle East emerges as a vital hub of growth, diversification, and innovation. Insights from the Economist Impact’s “Trade in Transition: Regional Insights” (2024) report underlines the region’s ambitious trajectory, highlighting key trends shaping its economic landscape

Middle East Economy – A Balancing Act

The Middle East’s economy was forecasted to grow by 2.3% in 2024, driven by favorable commodity prices and strategic reinvestments. Export growth was projected to hit 3.8%, ranking the region among the top three fastest-growing export markets globally, alongside Asia-Pacific and Africa. However, the report import growth

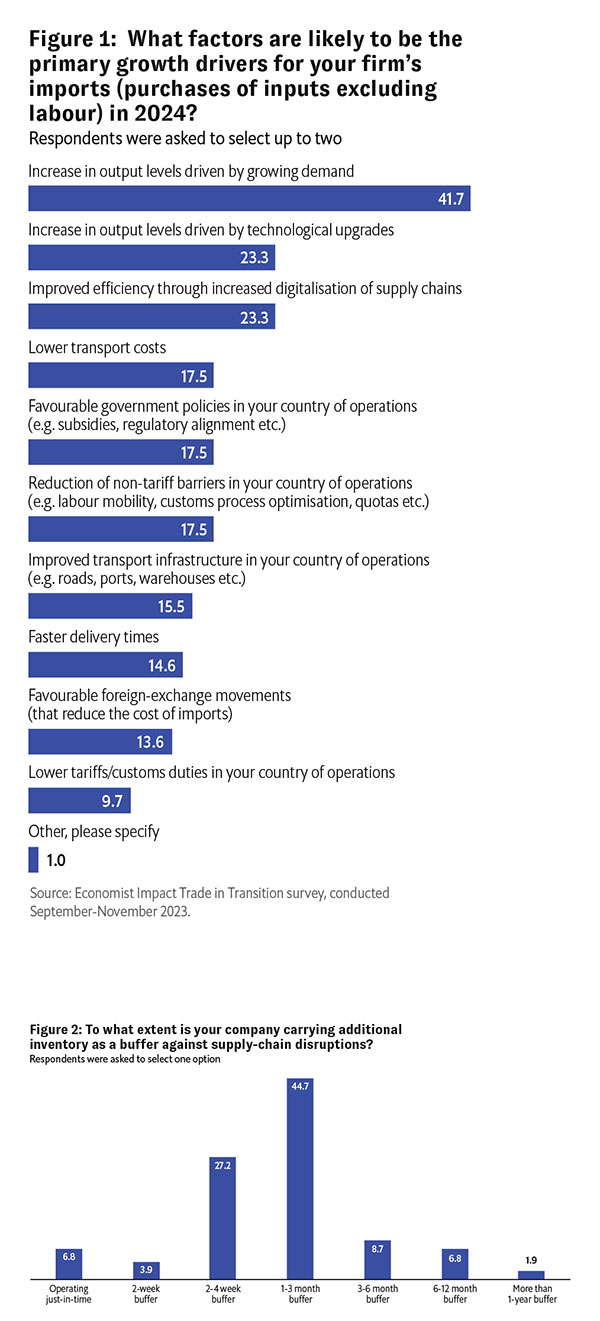

was pegged at a moderate 4.6%, reflecting a recalibration following 2023’s robust expansion. 42% of surveyed supply-chain executives cite increased domestic output levels — spurred by rising demand — as the leading driver of export growth.

Diversification Beyond Hydrocarbons

The Gulf region is actively diversifying its economies, leveraging hydrocarbon profits to expand into sectors like technology, logistics, tourism, and renewable energy. Key initiatives, such as the UAE’s non-oil trade growth (up 14.4% in H1 2023) and Saudi Arabia’s Vision 2030, are driving foreign investment and boosting sectors like construction and manufacturing.

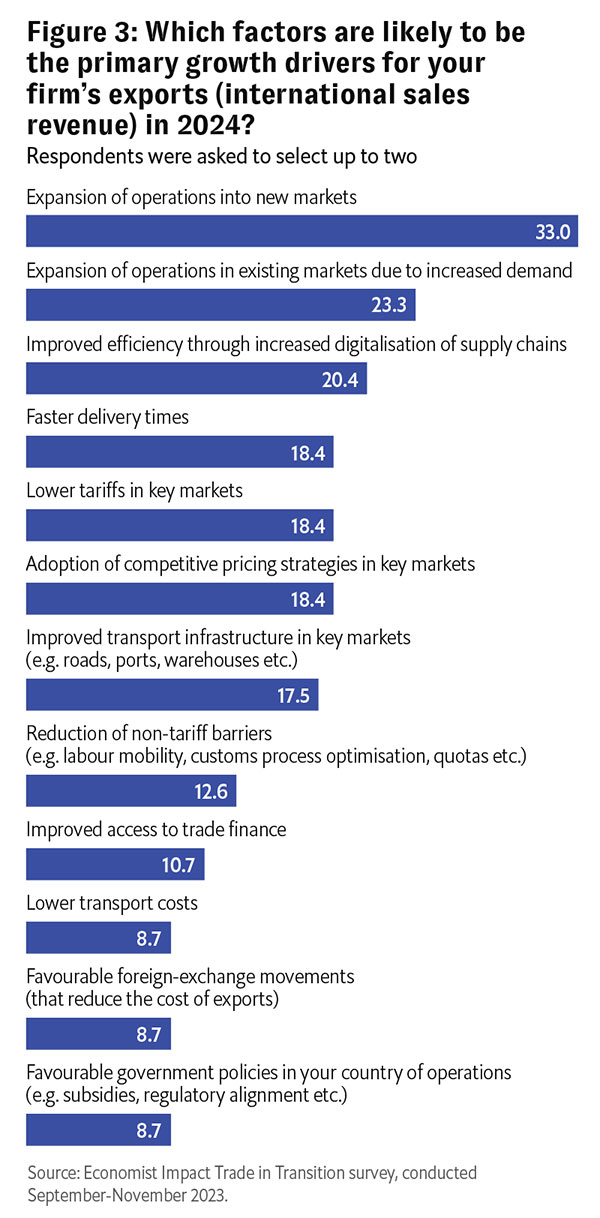

Moreover, businesses in the region are adapting supply chains to enhance resilience, with 43% diversifying suppliers and 45% incorporating buffer times of 1 – 3 months to mitigate disruptions and ensure continuity. This shift creates opportunities in high – value manufacturing and service industries while prioritizing supply chain robustness.

Strategic Market Expansion

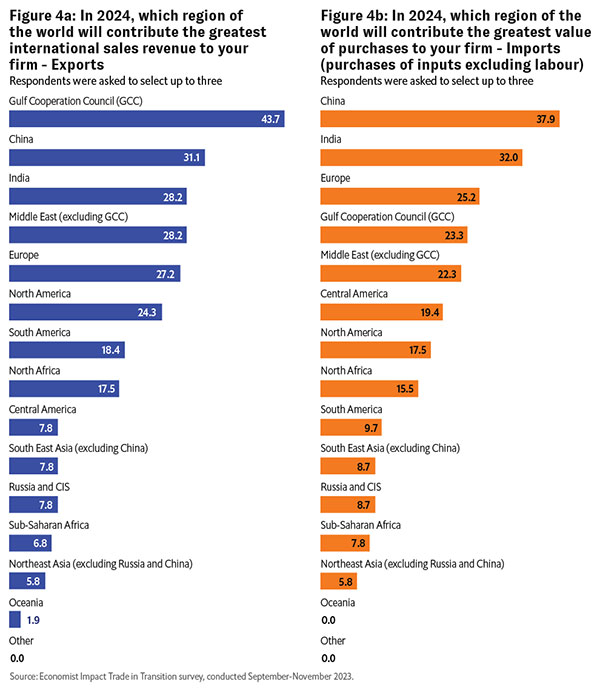

The Gulf region’s economic diversification efforts are driving the exploration of new markets and trade routes, particularly in Asia-Pacific and Africa. Governments are prioritizing non-oil exports to fuel diversification, with 33% of Middle Eastern business executives identifying market expansion as the primary export growth driver for 2024. Since 2022, countries like the UAE and Saudi Arabia have intensified efforts to build trade partnerships beyond the Gulf.

Bilateral Agreements to Boost Non-Oil Trade:

The UAE signed a free trade agreement (FTA) with Georgia, with the potential to double non-oil trade between the two nations within five years. This reflects the Gulf’s proactive stance in securing strategic trade relationships to bolster economic diversification.

Ongoing Negotiations with Emerging Economies:

The UAE is in discussions for comprehensive economic partnership agreements (CEPAs) with South Korea, Thailand, and Chile. These agreements aim to open new trade corridors and enhance market access for Gulf-based businesses.

Deepening Ties with Asia-Pacific:

Saudi Arabia’s strengthened trade relationship with China highlights a shift toward integrating with the Asia-Pacific economic landscape. This partnership is expected to enhance trade volumes and facilitate technology and infrastructure investments.

Leveraging Neutrality for Market Penetration:

Gulf nations’ neutral geopolitical positioning allows them to establish trade relations across diverse regions. This strategy enables a broader reach, fostering economic resilience and reducing reliance on traditional markets.

Building Global Ties to Drive Non-Oil Trade

The Gulf’s diversification strategies are fueling the opening of new markets and trade routes, particularly in Asia – Pacific and Africa. Governments are prioritizing non – oil exports,

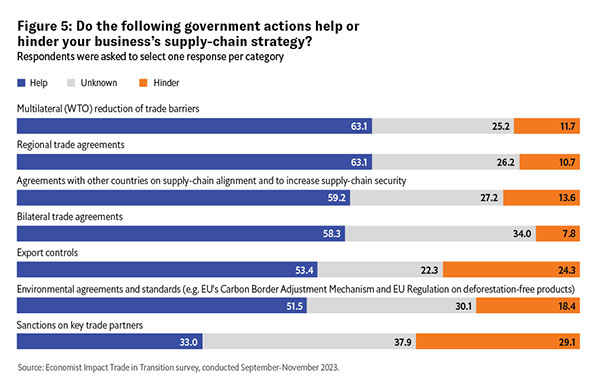

with 33% of Middle Eastern executives identifying market expansion as a key driver of export growth in 2024. Countries like the UAE and Saudi Arabia are enhancing trade relationships beyond the Gulf, such as the UAE’s FTA with Georgia and ongoing negotiations with South Korea, Thailand, and Chile. Meanwhile, trade agreements with China and India underscore the region’s increasing integration with Asia. These partnerships not only expand market access but also strengthen supply – chain strategies, with 63% of surveyed businesses reporting benefits from bilateral trade agreement.

FTAs to Boost Economic Integration: The UAE’s Free Trade Agreement with Georgia aims to double non – oil trade within five years. Similar agreements under negotiation with South Korea, Thailand, and Chile reflect the region’s commitment to building diverse trade networks.

Strengthening Ties with Asia’s Largest Economies: Saudi Arabia is enhancing trade relations with China, the region’s second most important export market and top import market. The UAE’s trade deal with India further underscores Asia’s growing significance, with India ranking as the third most important export and second most important import market.

Regional and Global Trade Corridors: While the GCC remains the primary export destination for Middle Eastern firms, businesses are increasingly leveraging new trade corridors across Asia – Pacific and Africa to diversify revenue streams and reduce reliance on traditional markets.

Supply Chain Resilience Through Bilateral Agreements: Nearly 63% of businesses in the Middle East find bilateral trade agreements beneficial for enhancing supply – chain strategies, enabling them to build additional supplier relationships and mitigate disruptions.

The Economist Impact report, Middle East Global Ascent: Strategic Shifts, Diversification, and Market Expansion in the Middle East’s Economic Landscape, highlights the Gulf region’s transformative journey toward economic resilience. By leveraging their neutral geopolitical stance, Middle Eastern nations are opening new markets, forging strategic trade agreements, and reducing dependency on hydrocarbons. With a focus on non-oil sectors like technology, logistics, and manufacturing, these efforts arecreating a dynamic environment ripe with opportunities for businesses to thrive.

For the CSS Group, this evolving landscape presents immense potential. As the Gulf continues to prioritize supply chain diversification and global connectivity, we are well – positioned

to play a key role in enabling businesses to navigate new trade routes and expand their operations seamlessly. With our expertise and strategic presence in the region and beyond, we

are committed to supporting our partners in capitalizing on the Middle East’s ascent as a global economic powerhouse.