The Global Shipping Landscape Reimagined

The Global Shipping Landscape Reimagined

The 2025 container shipping industry is undergoing one of its most significant transformations in decades. The breakdown of traditional alliances, divergent capacity expansion strategies, and exposure to shifting trade policies are redrawing the competitive map. As the world’s top carriers reposition for the next phase of maritime logistics, three distinct approaches to cooperation, independence, and stability are defining the global stage.

Alliance Strategies: Independence Cooperation, and Stability

The “Stand-Alone” Giant (MSC): Mediterranean Shipping Company (MSC) has taken a bold independent path after ending its long-standing 2M partnership with Maersk. The company’s “go-it-alone” model gives it full control over its network, enabling faster decision-making and operational agility. By the end of 2025, MSC will operate a fully independent, globally integrated network, positioning itself as a self-sufficient carrier capable of responding rapidly to changing trade conditions.

The “Reliability-Focused” Partners (Gemini Cooperation): In contrast, Maersk and Hapag-Lloyd are moving toward a more collaborative yet efficiency-driven strategy with the launch of the Gemini Cooperation, effective February 2025. Their approach focuses on schedule reliability and network precision rather than scale. Using a hub-and-spoke model, Gemini will deploy larger vessels within feeder services to improve punctuality and lower inventory costs for clients, emphasizing predictability and service quality as the foundation of their competitiveness.

The “Stable” and “Regrouped” Alliances: Meanwhile, the Ocean Alliance—comprising CMA CGM, COSCO, Evergreen, and OOCL—remains the only major alliance operating without change. Its stability and consistency stand out in a period of disruption. At the same time, ONE, HMM, and Yang Ming have regrouped to form the Premier Alliance, aiming to strengthen collective coverage and maintain competitive service. Together, these alliances represent the segment of the industry favoring steady cooperation and reliable service over radical restructuring.

Capacity Expansion: Aggression vs. Restraint

Capacity Expansion: Aggression vs. Restraint

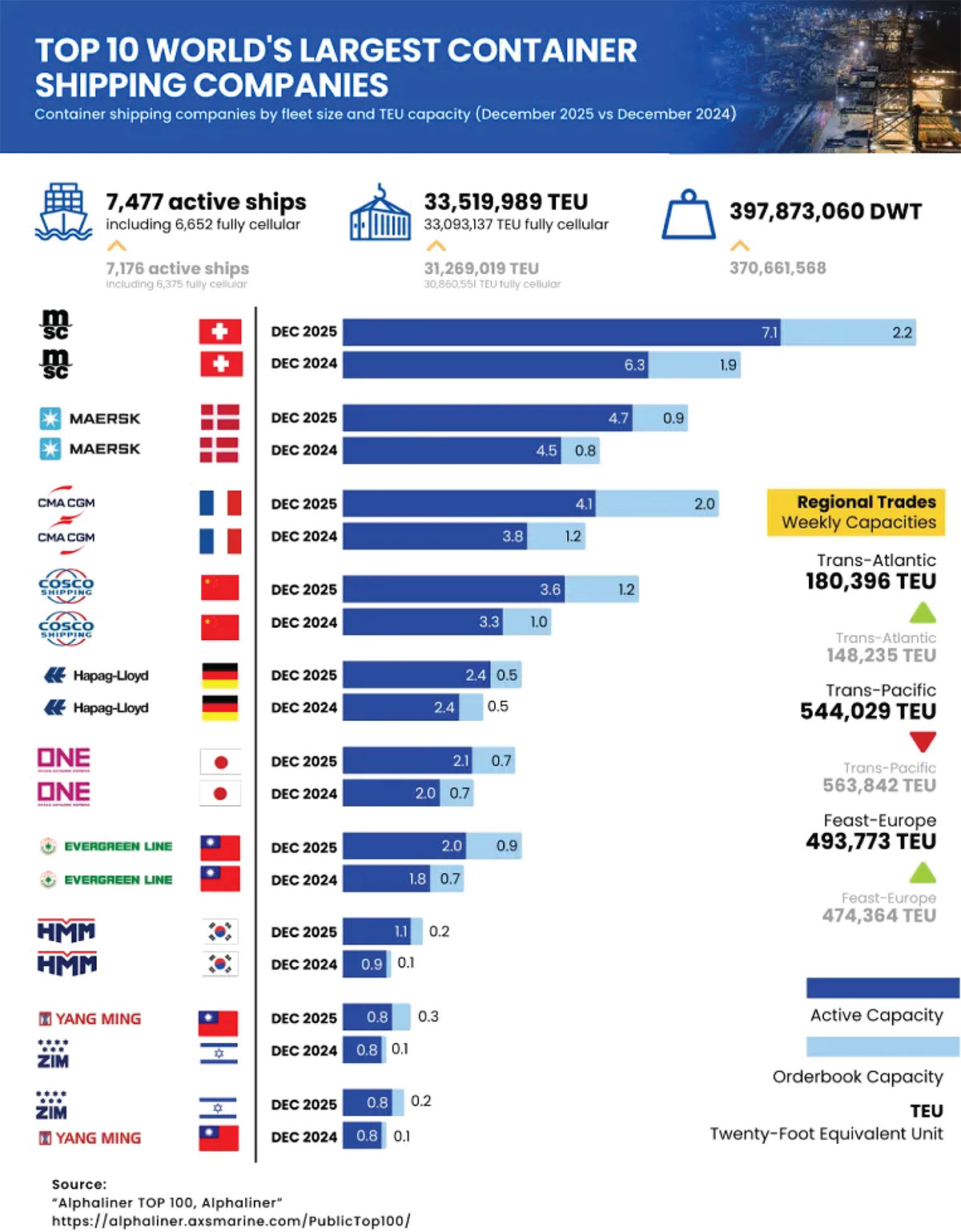

Industry Trends: Scale, Modernization, and Efficiency Fleet Composition and Geopolitical Exposure Across the global fleet, carriers are pursuing very different growth paths. Some are expanding aggressively to capture scale advantages, while others are focusing on profitability, logistics integration, and sustainability. MSC continues to dominate in capacity and is far ahead of its competitors. By December 2025, the company’s active fleet is expected to reach approximately 7.1 million TEU, compared with Maersk’s 4.6 million TEU. Remarkably, MSC’s orderbook alone, at around 2.1 million TEU, exceeds the entire active fleet sizes of major carriers such as ONE or Evergreen. This aggressive expansion underscores MSC’s ambition to maintain market leadership through scale and reach.

A significant battle is unfolding for second place between Maersk and CMA CGM. Although Maersk currently holds that position, CMA CGM’s rapid expansion threatens to change the rankings. The French carrier’s orderbook of 1.9 million TEU, compared to Maersk’s 0.8 million TEU, lifts its total pipeline capacity to roughly six million TEU, surpassing Maersk’s 5.4 million. CMA CGM’s strategy is clearly focused on asset growth and modernization, while Maersk is pivoting toward integrated logistics and digital solutions to enhance long-term profitability rather than pure fleet expansion.

HMM has also achieved a major milestone by joining the “One-Million-TEU Club.” The Korean carrier has doubled its fleet over five years through a government-backed expansion initiative. Uniquely, HMM’s entire newbuilding program is domestically constructed, aligning its growth strategy with South Korea’s national shipbuilding policy and supporting the domestic maritime industry.

Industry Trends: Scale, Modernization, and Efficiency

The global industry continues to favor larger vessels as operators seek to lower unit costs and enhance fuel efficiency. For the first time, Ultra Large Container Ships (ULCS) with capacities exceeding 15,000 TEU have overtaken the 5,100–10,000 TEU segment in global market share. The push for scale is especially visible in Evergreen’s strategy. The company’s orderbook represents nearly 44 percent of its existing fleet, equivalent to 0.85 million TEU on order compared with an operational fleet of 1.94 million TEU. This indicates an ambitious modernization and upsizing program.

By contrast, carriers such as COSCO and Yang Ming are adopting more conservative order-to-fleet ratios, prioritizing measured growth and profitability over rapid capacity additions. The divide illustrates two distinct strategic mindsets—one driven by modernization through new assets, and the other by operational optimization and balance sheet discipline.

Fleet Composition and Geopolitical Exposure

New U.S. trade policies, including potential port fees on Chinese-built vessels, are forcing carriers to reconsider the composition and deployment of their fleets. These policies have exposed varying levels of risk among operators. COSCO and CMA CGM are the most vulnerable due to their reliance on Chinese-built tonnage. In contrast, MSC and Maersk, whose fleets are more diversified in origin, are better positioned to absorb potential cost impacts and maintain flexibility in vessel allocation.

To adapt to these emerging risks, carriers with greater exposure are expected to redeploy Chinese-built vessels away from U.S.-bound routes and assign them to other regions such as intra-Asia or Europe–Africa trade lanes. This adjustment requires a new kind of operational flexibility in which the nationality of vessels becomes a strategic factor alongside capacity, cost, and sustainability.

From December 2024 to December 2025, weekly trading capacities have also shifted noticeably. Trans-Atlantic and Feast–Europe services have seen an increase in capacity, reflecting stronger trade links and steady demand. Conversely, Trans-Pacific capacity has declined as carriers reallocate ships to other routes amid changing demand patterns and evolving geopolitical considerations.

A Market in Motion – The Transit System Analogy

The 2025 shipping industry can be visualized as a rapidly evolving city transit network. MSC is building its own private superhighway, adding ships and routes at an unprecedented pace and operating independently across the globe. Maersk and Hapag-Lloyd, through the Gemini Cooperation, are designing a synchronized metro system where reliability and precision outweigh coverage breadth. CMA CGM, on the other hand, is expanding its fleet capacity so rapidly that it resembles a transit authority purchasing more trains and carriages than any competitor, betting that capacity and reach will secure market dominance. Each of these models reflects a different vision for the future of global shipping—autonomy, reliability, and scale—each with unique strengths in a volatile trade environment.

The Human Element Behind Transformation

Behind every fleet expansion, alliance shift, and redeployment plan are leaders driving transformation. The shipping industry’s evolution is not only about ships and networks; it is about leadership, agility, and the ability to operationalize large-scale change. The most successful organizations are those with executives who can balance strategic foresight with executional discipline and cultural alignment.

Alcott Global continues to work with supply chain organizations to identify and place leaders capable of steering through uncertainty. These professionals are shaping the next era of logistics, building resilience, and guiding the transformation that defines the industry’s future.

Strategy Defines the Winners

The global container shipping industry in 2025 is not just a race for capacity; it is a test of strategy. Companies that can balance independence with cooperation, growth with reliability, and innovation with discipline will lead the next phase of global trade. As alliances evolve and fleets expand, the defining factor will be how well leadership teams transform these strategies into measurable performance and long-term advantage. The industry’s giants are no longer merely moving cargo—they are redefining how the world’s supply chains connect and compete.